Demographic cycles, generational expectations, and evolving retirement income solutions are reshaping the cost and opportunities of retirement plan design

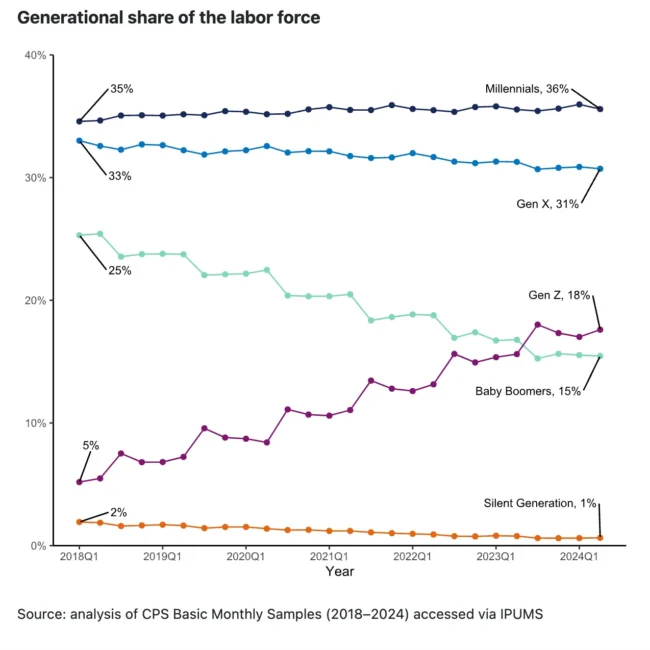

Every day, roughly 11,400 Baby Boomers turn 65, ushering in a historic retirement wave known as “Peak 65”. As this generation steps into retirement, the makeup of the workforce is changing fast. Baby Boomers, once the largest group on the job, now make up just 15 percent of workers, while Gen Z has edged ahead at 18 percent.

While the shift looks simple on a chart, it brings real-world challenges. Experience, leadership, and tribal knowledge are walking out the door, while younger, eager, but less-experienced workers are stepping in.

So what does this mean for your organization? How can employers offer a retirement benefit that speaks to the generational shift?

Let’s look at ways to design a plan that supports those near retirement, those just starting out, and everyone in between, because your plan can be a powerful benefit for all.

Baby Boomers and income

Have you noticed older employees talking more about retirement? These senior employees are no longer focused on saving; they’re focused on living in retirement.

Plan sponsors should review options based on whether participants intend to:

- Remain in the plan | Offer in-plan annuities, systematic withdrawal capabilities, or managed account options. Studies show that 86% of workers want their employers to provide retirement income plans with multiple income choices.

- Take a distribution | Provide educational resources such as rollover workshops, access to advisory support, and guidance on account consolidation.

As a fiduciary, keep in mind that all plan decisions should be made in the best interest of participants and their beneficiaries. Consider offering easy-to-understand comparisons, customizable income projections, and Social Security workshops to help employees navigate this new phase confidently.

Generation X’s time to get serious

Gen X is in their prime saving years, with many about a decade from retirement. These employees often want and need professional financial advice, access to emergency savings, and guidance around tax efficiency.

As a plan sponsor, consider on-site or virtual education sessions to highlight catch-up contribution opportunities and explain the new Roth catch-up rules for high earners. Partnering with a financial professional can help employees gain confidence and preparedness.

Millennials are caught in the middle

Your Millennial employees are multitasking life priorities, such as student debt, childcare, home ownership, and elder care, which can crowd out the importance of retirement savings.

Plan sponsors are challenged to support “stop-start” savers: these are employees who pause contributions to tackle mid-life responsibilities. One way to support this group is auto-enrollment and re-enrollment, which could remove the task of signing up for the plan.

Another powerful strategy is non-work financial communications, which has often been seen as “taboo” or outside of the workplace responsibility. Offering general financial education could provide meaningful clarity for these workers and help them become less financially distracted at work. Topics may include interest rates, credit scores, and life events such as birth, adoption, marriage, divorces, and estates.

This approach provides employees with credible information and consistent nudges to remind employees about the importance of long-term financial preparation.

Generation Z seems to be on the right track

Gen Z enters the workforce as digital natives with high expectations. Many are saving early, with average balances around $78,000, a strong start for young savers.

To engage Gen Z, sponsors should consider:

- Auto-enrollment (e.g. 10%) or auto-escalation to align with their “set it and forget it” preference.

- Mobile-first tools, self-service, and on-demand learning options to appeal to their desire for independence.

Economic pressures & salary expectations

Rising inflation, housing costs, and general living expenses push employees to expect higher salaries and faster earning growth. This can erode “available benefit dollars”.

Employers must balance the narrative: “We may not give 10% salary hikes every year, but your long-run retirement benefit is real, has the ability to compound, and is extremely valuable.”

Looking towards the future

The labor market is shifting: Boomers are retiring, AI is reshaping roles, and a digitally native Gen Z is demanding intuitive, purposeful benefits. For plan sponsors overseeing plans, the opportunity is to modernize your 401(k) as a strategic talent tool, not just a basic nice-to-have benefit.

Begin by reinforcing accumulation features (auto-enroll, auto-escalation, flexible matching) to appeal to Gen Z and Millennials, support Gen X in their “last stretch” savings phase, and maintain relationships with retirees through in-plan income solutions, backed by strong fiduciary due diligence and layered education.

Done well, your retirement program becomes a driver of recruitment, retention, and cost discipline; a differentiator in a tight labor market where benefits increasingly compete with salary.

[1] “Changes in the U.S. Labor Supply.” Trendlines. U.S. Department of Labor. Aug 2024.

[2] “Employees want income options in retirement plans, survey says.” Greenwald Research. 23 Jan 2025.

[3] “Gen Z’s road to retirement.” The Currency. 11 Oct 2024.

This information was developed as a general guide to educate plan sponsors and is not intended as authoritative guidance or tax/legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. ©401(k) Marketing LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent